pay as you earn calculator

Revised Pay As You Earn REPAYE is a government program that can help you save money on your student loans. Pay As You Earn PAYE is the system which employers use to extract income tax and national insurance directly out of your wage to hand over to the taxman.

Pay As You Earn Paye Calculator Mentor

This is 5 tax charged on the total bonus up to 15 of an individuals basic salary.

. Pay As You Earn PAYE Calculator Mentor Pay As You Earn PAYE Calculator This Pay As You Earn PAYE calculator shows you your new monthly student loan payment and how much student loan forgiveness you can get when you enroll in PAYE student loan repayment. Income-driven repayment plans can help lower your monthly student loan payment. A key thing to bare in mind is that a proportion of statutory deductions are removed before the tax calculationthe amount deducted is either 15 of total statutory contributions or ZMW 25500 whichever is the minimum.

If you opt for this program youll only pay 10 percent of your discretionary income each month towards the loan. Your income was calculated as hourly. Under this system the employer is required to.

All Taxes Returns And Compliance. Pay as You Earn PAYE How much is your net pay after income taxes. The tax is charged up to 50 of the basic salary at a rate of 5.

Revised Pay As You Earn Repayment Calculator This calculator determines the monthly payment and estimates the total payments under the revised pay-as-you-earn repayment plan REPAYE. B deduct tax due from the emoluments. Why file a return.

Finish in 20 minutes or less. Student Loan Pay As You Earn PAYE Calculator Are you wondering how enrolling in the Pay As You Earn PAYE federal student loan repayment plan could impact your student loan payments. 80 of users get tax refunds - more than R300 million in refunds paid.

TaxTim asks simple questions one-by-one then fills in your tax return for you instantly. PAYE Calculator Calculate your take home pay through the Pay As You Earn PAYE system. What is a PRN.

The REPAYE plan now allows some borrowers to cap their monthly student loan payments at 10 of their discretionary income. Enter Current Loan Info Student Loan Balance Average Interest Rate. Ok thank you Please remind me.

Calculate pay as you earn and Napsa in Zambia from anywhere Remember according to NAPSA maximum contribution ceiling deductible is now K122180 which is 5 percent of the contribution ceiling. Yes No Household Income. Apply for a penalty waiver.

When is my return due. Its considered one of the lowest repayment options available. You have 12500 personal allowance this tax year or 1041month - which means that for the first 12500 that you are earning this year you wont pay income tax.

One of these is the program Pay As You Earn or PAYE. Any amount in excess is added to the total cash emoluments. This is a method of deducting tax from employees emoluments in proportion to what they earn.

Use our calculator below to find out. Get the Right Figure. Youll only start paying tax once you earn above this limit and only for the amount earned above this limit.

If the overtime paid is more than 50 of the employees monthly basic salary the excess of the 50 is taxed at 10. Use our calculator to see how REPAYE may be able to lower your monthly student loan payments. This reduces the amount of PAYE you pay.

Pay As You Earn PAYE in Ghana is a tax deducted from employees income and is paid by an employer on behalf of the employee. It also changes your tax code. How to make a payment.

Make tax season quick and easy with TaxTim. What is a return. Revised Pay As You Earn REPAYE Calculator This Revised Pay As You Earn REPAYE calculator shows you your new monthly student loan payment and how much student loan forgiveness you can get when you enroll in REPAYE student loan repayment.

Payment due dates. Enter Current Loan Info Student Loan Balance Average Interest Rate Current Monthly repayment. Income tax is calculated progressively using income tax bands and personal relief rate came into effect on 1st January 2021.

Type your monthly pay after deducting PPF NSSF or PSPF Contribution Then click on the calculate PAYE button to find your monthly Income Tax payable. A quick and efficient way to compare salaries in Uganda review income tax deductions for income in Uganda and estimate your tax returns for your Salary in UgandaThe Uganda Tax Calculator is a diverse tool and we may refer to it as the Uganda wage calculator. An Independent Earner Tax Credit IETC of has been applied.

Use DollarGeeks Pay As You Earn PAYE Calculator to see how PAYE may be able to lower your monthly payments as well as result in forgiveness of your student loans. Yes No Are you married. Pay As You Earn or PAYE is a federal student loan repayment plan that is good for married borrowers grad students and those with qualifying low incomes.

PAYE Calculator Tax Year 20202021 - including UIF. The federal government offers several types of repayment plans to help ease the pressure on new borrowers. Pay As You Earn PAYE Pay As You Earn PAYE Motor Vehicle Import Duty.

For instance if my greedy employers pay me ZMW 400000 every month then the tax calculations would be as follows. 250000 people prefer TaxTim over eFiling. Use our PAYE Calculator to see how PAYE may be able to lower your monthly payments as well as result in forgiveness of your student loans.

Calculate your take home pay in Uganda thats your salary after tax with the Uganda Salary Calculator. Skip the tax forms. Motor Cycle Import Duty.

IDR plans include Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR Plans. And c remit tax deducted to Zambia Revenue Authority ZRA. A calculate tax payable by every employee.

Pay As You Earn. Under these plans your monthly payment is based on your income and family size. Personal Information Do you have any graduate loans.

If it was supposed to be weekly click the button below. Lets see how different your payments could be. How to file a return.

Hence contribution payable by the employers is currently at K244360 constituting 5 percent employer share and 5 percent employee share. What are liability types. Under this federal program PAYE limits your monthly student loans to 10 of your discretionary income.

What is Pay As You Earn PAYE.

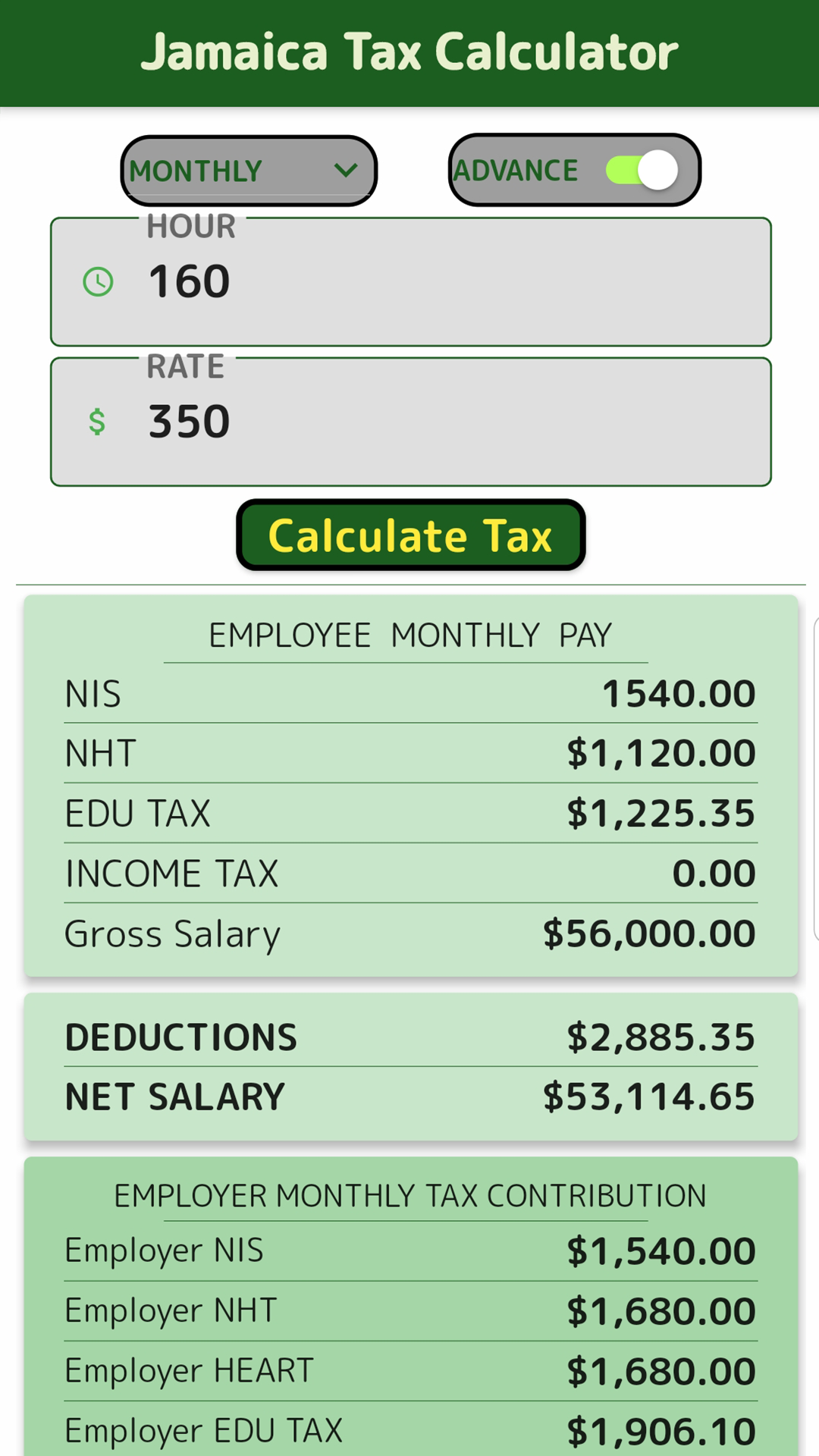

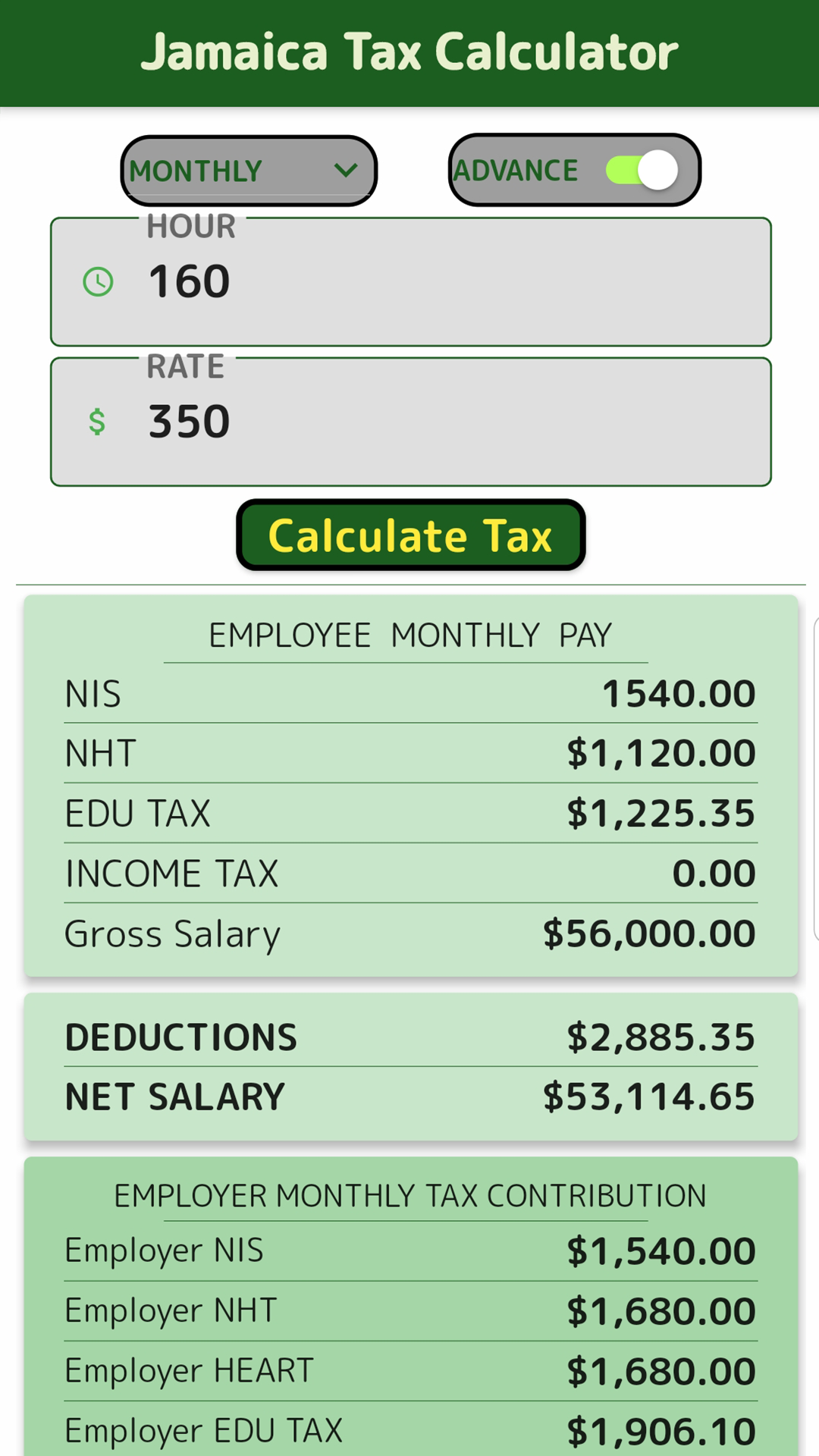

Jamaica Tax Calculator It S All Widgets

I Built An Income Tax Calculator Using Formidable Forms For The Cook Islands Govcrate Blog

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Pay As You Earn Repayment Calculator

Paye Pay As You Earn Zambia Zambia Revenue Authority Zra Lenvica Hrms

0 Response to "pay as you earn calculator"

Post a Comment